An Overview of the Gaming Industry in Iran

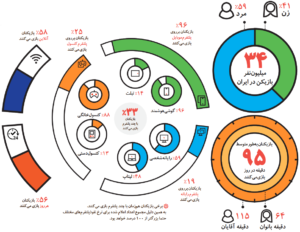

This section delves into a report published by Iran’s National Foundation of Computer Games about the state of the gaming industry in Iran in the year 2021 [1], and compares its findings with the global gaming industry status. The figure below provides a comprehensive overview of the most significant data on digital game consumption in Iran in 2021 based on this survey.

To examine the situation in Iran, the report first looks at the number and composition of gamers in the country. It’s important to note that a ‘gamer’ here is defined as someone who spends at least one hour per week playing games on at least one of the three platforms: mobile, console, or PC. According to the findings of this report, it’s estimated that there were over 34 million gamers across all platforms in 2021. The number of gamers in Tehran was estimated to be around 3.9 million.

Figure 1: Key information on digital game consumption in Iran in 2021 [1].

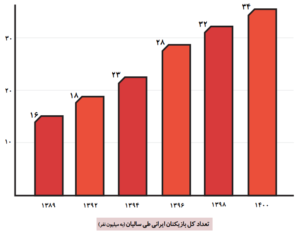

Overall, from 2010 to 2021, the total number of Iranian gamers has increased at a compound annual growth rate of 7%. This growth was more pronounced in the early 2010s, primarily due to the rise of mobile games, increased internet penetration, and wider access to mobile devices and the internet.

Accordingly, the per capita gamers in Iran in 2021 was around 41%. Currently, the countries with the highest gamer per capita in the world are Japan and the United Kingdom at 58%, and South Korea at 57%. This ratio is expected to reach around 65 to 70% by 2027 in these countries.

Figure 2: Total number of Iranian gamers over the years (in millions) [1].

The male-to-female gamer ratio in Iran in 2022 and 2020, and its comparison with the global scenario, is also presented in the following figure. It is observed that, similar to other parts of the world, the proportion of female gamers in Iran has increased, and in 2022, this composition in Iran has become very similar to that of the world.

Figure 3: Male to female gamer ratio in Iran and worldwide [1].

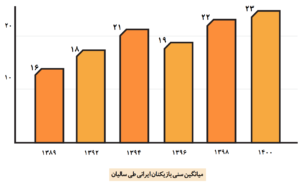

An analysis of the average age of gamers indicates that in the past three years, especially following the COVID-19 pandemic, changes in work styles and behavioral shifts have led to an increase in new gamers, higher engagement from existing players, and a growth in the total number of gamers. This has consequently raised the average age of gamers in the two most recent surveys conducted by the National Foundation of Computer Games, as shown in the figure below.

Figure 4: Average age of Iranian gamers over the years [1].

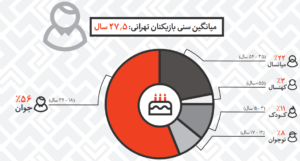

An important point in this survey is the average age of gamers in Tehran compared to the overall Iranian gamers. In 2019, the average age was 22 in Iran, while in Tehran, it was around 27.5 years.

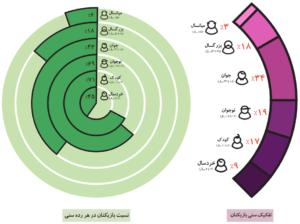

The examination of the age distribution of gamers shows that children and teenagers are the two age groups most inclined towards digital games, accounting for the highest proportion of gamers. This is noteworthy given the leisure time, access to platforms, and media consumption styles of these age groups. For the younger children, access is generally more restricted and under parental supervision, while time limitations can be a significant factor affecting the ratio of gamers in other age groups.

A notable point is the difference in the age groups of gamers in Tehran compared to the national average. As the following figure illustrates, in Tehran, the majority of gamers fall within the young adult age group, followed by the middle-aged group, contrary to the national average where teenagers form the largest group.

Figure 5: Age segmentation and the proportion of gamers in each age group in Iran in 2021 [1].

Figure 6: Age segmentation and the proportion of gamers in each age group in Tehran in 2021 [2].

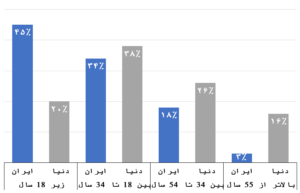

Comparing the age composition of gamers in Iran with the global average, it’s evident that the number of gamers under 18 is significantly higher in Iran, but the composition in other age groups is the opposite of Iran. This can be clearly seen in the figure below.

Figure 7: Male to female gamer ratio in Iran and worldwide [1].

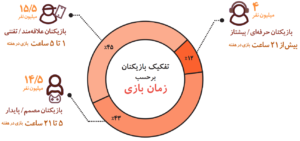

This report categorizes gamers based on their gaming hours per day into three groups:

- Professional gamers: those who play more than 21 hours per week,

- Enthusiast gamers: those who play between 5 to 21 hours per week,

- Determined gamers: those who play between 1 to 5 hours per week.

Based on this, the composition of gamers can be distinguished as shown in the figure below. Notably, there are 4 million professional gamers in the country who play more than 3 hours per day, a significant figure. However, this number requires interpretation and clarification, as 4 million active and professional gamers is a considerably high number for the country. According to the latest data collected, in the most recent league for console and mobile games in the country, organized by the National Foundation of Computer Games, approximately 1.34 million people registered, of which about 1.323 million were for PC games and the rest (around 17,000) for console games. Therefore, it seems that based on daily gaming hours, there may be many gamers in the country who play for long hours, but the number of gamers willing to participate actively and professionally in gaming events and competitions is much less than the figure stated in this survey.

Figure 8: Segmentation of Iranian gamers based on gaming time [1].

As the report explains, although gamers may appear as a homogenous group outside the gaming culture, allowing for an easy categorization under a single umbrella, different indices can be used to create various classifications of gamers. The duration of gaming is one of the most significant indicators for categorizing gamers. The findings of this research show a positive correlation between gaming time and other indicators such as spending, use of multiple gaming platforms, the extent of online gaming, and the ratio of daily gaming.

The following image presents the age distribution of Iranian gamers based on daily gaming duration and the type of gaming platform used, according to the survey results. It reveals that the highest daily gaming time belongs to the age group between 12 and 34 years, and this age group also predominantly uses PC and console platforms for gaming. Therefore, the primary audience for non-mobile computer games in the country is teenagers and young adults between the ages of 12 to 34.

Figure 9: Age distribution of Iranian gamers based on daily gaming duration and the type of gaming platform used [1].

Another interesting aspect of this report is the examination of the spending habits of Iranian gamers. In this context, spending refers to all the expenses that gamers incur for accessing game software or hardware through various methods. This figure includes, in addition to purchasing devices from stores or in-game spending, transactions such as buying and selling in-game currency through intermediaries and exchanges between players. It does not, however, account for those revenues of the gaming sector that do not fall under gamers’ spending.

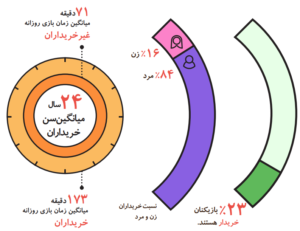

According to the data in this report, about 23% of gamers are willing to spend money on their gaming, of which 84% are male and 16% are female. Moreover, the average gaming time of purchasers is approximately 2.5 times that of the average non-spending gamers. Additionally, the average age of gamers who spend on their gaming is mentioned as around 24 years.

Figure 10: Number and composition of Iranian gamers willing to spend on gaming [1].

The survey data also indicates that the total expenditure of Iranian gamers on gaming in 2021 was about 19.3 trillion Tomans (approximately 740 million dollars). Despite the enormity of this figure, it’s important to note that a large portion of gamers’ expenses is allocated to hardware, particularly gaming consoles. This report reads, “86% of the total gamers’ expenditures are spent on purchasing hardware, especially gaming consoles. The significant increase in currency exchange rates and the direct dependence of hardware prices on it have led to this considerable financial turnover. To better understand the role of the dollar, it can be noted that the compound annual growth rate of gamers’ expenditures from 2017 to 2021 is 113% in Rial terms and only 33% in dollar terms. Comparing these figures with the 2019 survey reveals a staggering increase in gamers’ spending on console devices in 2021. To analyze this figure, it can be pointed out that between the 2019 and 2021 surveys, the new generations of PlayStation and Xbox consoles were released in the market, and the possibility of unlocking games for the older console generations in Iran increased, leading to a rise in their prices. The image below provides an estimate of the types of expenditures by Iranian gamers.

Figure 11: Types of expenditures by Iranian gamers in 2021 [1].

Of the total 512 billion Tomans spent on mobile games in the country, approximately 202 billion Tomans (about 40%) were spent on domestic games, indicating a 5% growth rate compared to previous years.

Moreover, of the total 18.8 trillion Tomans spent on consoles and PCs, about 16.6 trillion Tomans relate to hardware expenses, and 2.2 trillion Tomans to software expenses. Notably, the share of domestic games in these expenses is low, such that of the total 2.2 trillion Tomans spent on software, only about 18 billion Tomans, less than 1%, is attributed to Iranian computer or console games.

The survey results demonstrate that although the spending on domestic console and PC games increased with a compound annual growth rate of 18% from 2014 to 2021, the substantial increase in foreign games on these platforms and the high currency exchange rates in recent years have actually decreased the share of domestic games in the total console and PC games. Consequently, the share of domestic games has consistently decreased over the years, dropping from 9% in 2014 to 2% in 2019, and below 1% in 2021.

Figure 12: Total expenditure of console and PC platform gamers in 2021 [1].

The 2021 survey by the National Foundation of Computer Games also studied the favorite genres among Iranian gamers, with results illustrated in Figures 13 and 14 below.

Figure 13: Favorite game genres among Iranian gamers by age group [1].

Figure 14: Favorite games among Iranian gamers by age group [1].

Regarding the most popular games among all Iranian gamers, according to the survey results, CALL of DUTY and the football games FIFA and PES rank as the top three favorites in the country. The subsequent games in this list can be seen in the figure below.

Figure 15: Most popular games and game genres among Iranian gamers in 2021 [1].

For comparison, the best-selling games and game genres in 2022 are detailed in the following figure.

Figure 16: Best-selling games and game genres in 2022 [3].

References

- “Game View 2021 – National Survey of Digital Game Players,” National Foundation of Computer Games – Center for Digital Games Research, 2021.

- “Game Map of Tehran,” National Foundation of Computer Games, 2019.

- “2022 Newzoo Free Global Games Market Report Dashboard,” Newzoo, 2022.